The future of green energy tax credits.

Energy efficient roof tax credit 2019.

The tax credit program was aimed to create jobs in the.

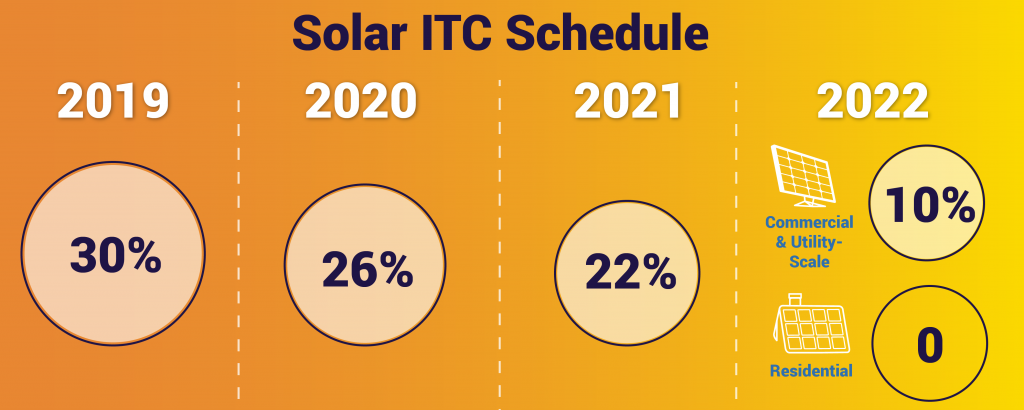

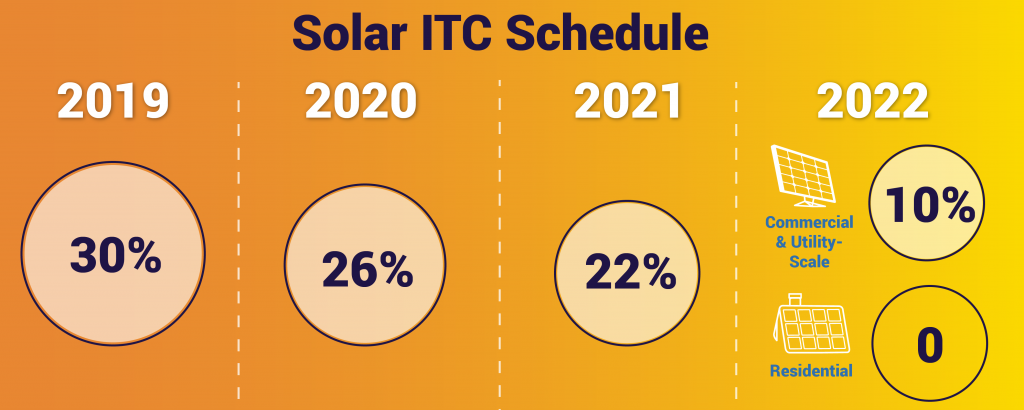

For systems installed after this date but before january 1 st 2021 the credits are worth 26.

Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs.

Through the 2020 tax year the federal government offers the nonbusiness energy property credit.

The united states has instituted a federal roofing tax credit which encourages homeowners to re roof with energy star products.

Claim the credits by filing form 5695 with your tax return.

December 31 2020 details.

Homeowners may qualify for a federal tax credit for installing certainteed energy star qualified roofing products.

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

The non business energy property tax credits have been retroactively extended from 12 31 2017 through 12 31 2020.

Under the current rules these tax credits become worth less each year.

Here s what you need to know when filing for tax years 2019 2020 and 2021.

A roofing tax credit is a credit given to homeowners who install a new more energy efficient roof on their home.

Dear patty yes you may qualify for the credit and you are going to need to look at form 5695 residential energy.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

The renewable energy tax credits are good through 2019 and then are reduced each year through the end of 2021.

How do i go about claiming an energy tax credit for a new roof.

10 of cost up to 500 or a specific amount from 50 300.

Homeowners who made energy efficient improvements to their home can qualify for a federal tax credit but you must meet certain rules.

For upgrades installed before december 31 st 2019 the full 30 tax credit applies.

Equipment tax credits for primary residences.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

Must be an existing home your principal residence.

The residential energy credits are.

Summary of tax credit under the bipartisan budget act of 2018 which was signed in february 2018 a number of tax credits for residential energy efficiency that had expired at the end of 2016 were renewed.